Texas Dow Employee Credit Union, commonly called TDECU, was founded by the employees of Dow Chemical Company in 1954. Membership was initially limited to Dow and Ethyl-Dow employees

As of June 2017, it has over 263,000 members, with assets of $3.05 billion.

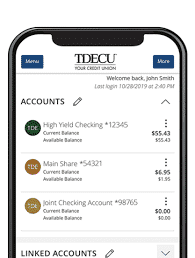

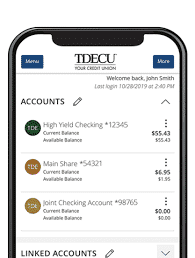

The credit union offers the following services:

- Checking and savings accounts

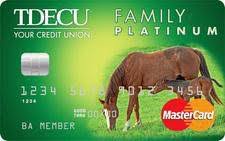

- Credit cards

- IRAs

- Money Management

- Mortgages

- Auto, home equity, and personal loans

- Homeowners, life, health, and auto insurance.

- Financial planning and investment services

TDECU has had multiple acquisitions over the years, including Bluebonnet Credit Union in 2011, Hancock Bank in 2013, and FMC Technologies in 2014.

In August 2020, the company fired an employee who made racist remarks on a social media platform.

Texas Dow Employee Credit Union maintains a corporate office in Lake Jackson, Texas.

Texas Dow Employee Credit Union, commonly called TDECU, was founded by the employees of Dow Chemical Company in 1954. Membership was initially limited to Dow and Ethyl-Dow employees

As of June 2017, it has over 263,000 members, with assets of $3.05 billion.

The credit union offers the following services:

History

- Checking and savings accounts

- Credit cards

- IRAs

- Money Management

- Mortgages

- Auto, home equity, and personal loans

- Homeowners, life, health, and auto insurance.

- Financial planning and investment services

TDECU has had multiple acquisitions over the years, including Bluebonnet Credit Union in 2011, Hancock Bank in 2013, and FMC Technologies in 2014.

In August 2020, the company fired an employee who made racist remarks on a social media platform.

Texas Dow Employee Credit Union maintains a corporate office in Lake Jackson, Texas.

I have been a loyal client of TDEDU for over 6 years. I currently have 2 automobile loans and one construction loan outstanding and have been making payments of a little under $1,000 monthly. Over the last 6 years I surmise I have paid TDECU around $100K in automobile loans and other construction-related loans. I have never missed a payment and in fact had planned to pay off my current loans early.

In March 2020 I was put on furlough with my employer. In May 2021 I was formally terminated and I have not found employment since. My salary was approximately $190K ($175K comp + bonus). Since my termination my family and I have been living off her salary ($75K) and unemployment ($28K in 2020). I sought (and received) from TDECU two forbearances in 2020. Since I have not found employment, I sought another in March 2021. I learned in late March the last request was not granted.

Last Saturday I received from TDECU a NOTICE OF DEFAULT AND OF INTENT TO ACCELERATE relating to one of the automobile loans. This was sent after I missed 2 payments. The letter states that the full loan will be called if I do not make both payments, plus interest, plus penalty by April 11. TDECU has already reported this and my credit has been negatively impacted.

I’ve called TDECU 6 times over the last 2 days. The first 5 were disconnected. On the last call I finally made it through to the Loan Resolution Department and left a message for a manager to return my call.

The Default notice was shocking, stunning, disappointing and frankly astonishing. While on hold on the 6 referenced calls in the background music I was told “Life is challenging, we have you covered,” “Putting your needs first,” and “We are here for you.” TDECU has been anything but that the last 4 weeks. Our mortgage company is working with us, my student loan provider is working with us. Basically all of our lenders have worked with us in some form or fashion. Except TDECU.

As noted in the attached email I received today, TDECU still wants me to borrow from them. Frankly, it will be a frozen day in Hell when we borrow another nickel from TDECU. Due to our dramatic drop in income, we are expecting a refund from the IRS any day and also should be receiving stimulus check since my wife’s salary is under the Coronavirus Relief threshold and we have 2 children. The moment we have these funds the accounts will be brought current. Once I return to work, all 3 accounts will be paid off and closed permanently.

This email is going to be sent to each member (currently 10) of the TDECU Board of Directors, Houston Chronicle and other local/regional websites.

TDECU has some nerve.